13 Must-Read Personal Finance Books

September 6th, 2024

Financial literacy is the key to unlocking a life of freedom and security, and the journey often begins with a good book. If you’re looking to take control of your financial future, we’ve curated a selection of 13 influential books that have stood the test of time, offering timeless advice on wealth-building, investing, and planning for the future. These books are not just for the wealthy; they provide valuable lessons for anyone seeking to improve their financial standing.

Think and Grow Rich by Napoleon Hill

Published in 1937, Napoleon Hill’s Think and Grow Rich is one of the most famous self-help books of all time. Hill spent over 20 years studying successful individuals, including Andrew Carnegie, Thomas Edison, and Henry Ford. The book condenses his findings into 13 principles for achieving success and wealth.

The book’s timeless advice is a must-read for anyone serious about personal and financial development. It’s not just about getting rich; it’s about cultivating a mindset that attracts wealth and success.

Rich Dad Poor Dad by Robert T. Kiyosaki

Rich Dad Poor Dad has become a personal finance classic since its publication in 1997. Robert T. Kiyosaki uses the contrasting financial philosophies of his two “dads”—his real father (the Poor Dad) and his best friend’s father (the Rich Dad)—to teach important financial lessons.

The book emphasizes the need for financial literacy, which is often overlooked in traditional education systems. Kiyosaki’s straightforward, relatable style makes complex financial concepts accessible, making this book an excellent starting point for beginners.

The Millionaire Next Door by Thomas J. Stanley and William D. Danko

Published in 1996, The Millionaire Next Door debunks the myth that most millionaires lead lavish lifestyles. Instead, Stanley and Danko reveal that many wealthy individuals live frugally and manage their money wisely.

The authors found that most millionaires live in modest homes, drive used cars, and avoid conspicuous consumption. This book is a sobering reminder that wealth is more often the result of hard work, discipline, and wise decision-making rather than inheritance or high income.

The Richest Man in Babylon by George S. Clason

First published in 1926, The Richest Man in Babylon is a collection of parables set in ancient Babylon, offering timeless lessons on wealth-building. George S. Clason’s stories are simple but profound, providing the foundation for many modern financial principles.

Just like The Millionaire Next Door, this book stresses the importance of living within your financial limits. Clason’s book is a quick read, but its lessons are powerful and enduring, making it a great resource for anyone looking to improve their financial habits.

The Wealthy Barber by David Chilton

The Wealthy Barber, published in 1989, is a personal finance guide written in the form of a story. David Chilton presents financial lessons through the character of Roy, a barber who offers advice to his customers.

The book covers essential but often overlooked topics like life insurance, wills, and retirement planning. The narrative format makes complex financial topics accessible and engaging, making it an excellent choice for readers new to personal finance.

The Automatic Millionaire by David Bach

David Bach’s The Automatic Millionaire, published in 2003, introduces the concept of “automation” in personal finance. Bach argues that building wealth doesn’t require discipline as much as it requires automation.

The book encourages readers to automate not only savings but also bill payments, insurance, and other financial responsibilities to avoid late fees and penalties. Bach’s straightforward approach is ideal for those looking for a simple, actionable plan to secure their financial future.

The 5 Years Before You Retire by Emily Guy Birken

Emily Guy Birken’s The 5 Years Before You Retire, published in 2014, is a practical guide for those nearing retirement. The book focuses on the crucial years leading up to retirement, offering actionable advice to ensure financial readiness.

The book helps readers calculate how much money they will need for retirement, accounting for various factors like healthcare and lifestyle. This book is an essential read for anyone approaching retirement, offering a clear roadmap to ensure a comfortable and financially secure future.

The Warren Buffett Way by Robert G. Hagstrom

The Warren Buffett Way, first published in 1994, delves into the investment strategies of Warren Buffett, one of the most successful investors of all time.

Robert G. Hagstrom provides insights into Buffett’s approach to investing, which focuses on long-term gains rather than short-term profits. Hagstrom’s book is a valuable resource for anyone interested in understanding how to invest wisely, following the principles of one of the greatest investors of all time.

Money: Master the Game by Tony Robbins

In Money: Master the Game, published in 2014, Tony Robbins interviews some of the world’s top investors to compile a comprehensive guide to financial freedom. The book is structured around seven steps to financial success.

Robbins emphasizes the importance of having a clear financial plan and goals and the final chapters focus on strategies to ensure a lifetime of income. Robbins’ book is packed with practical advice and insights from financial experts, making it a valuable guide for anyone serious about mastering their finances.

Start Late, Finish Rich by David Bach

In Start Late, Finish Rich, published in 2005, David Bach addresses those who feel they’ve fallen behind in their financial planning and offers a road map to catch up and achieve financial security. Bach outlines a straightforward approach to saving, investing, and spending wisely, emphasizing the idea that it’s never too late to turn your financial life around.

He introduces the “Latte Factor” concept, which shows how small changes in daily spending can lead to significant savings. Bach’s book is motivating and practical, offering hope and actionable steps for those who worry they’ve started too late to build wealth.

Buffettology by Mary Buffett and David Clark

In Buffettology, published in 1997, Mary Buffett and David Clark provide readers with insights into the investment strategies of Warren Buffett, one of the most successful investors of all time. The book breaks down Buffett’s investment principles, focusing on the importance of understanding the intrinsic value of a company before investing. It teaches readers how to think like Buffett, emphasizing long-term investments in quality companies.

Buffettology is a detailed guide for those looking to apply Buffett’s proven methods to their own investing, making it an invaluable resource for both novice and experienced investors.

A Year of Growing Rich by Napoleon Hill

In A Year of Growing Rich, published in 1993, Napoleon Hill offers readers a daily guide to achieving success and wealth. The book is structured as a series of 52 weekly lessons, each designed to inspire and motivate readers to pursue their financial and personal goals.

Hill draws on the principles from his classic work Think and Grow Rich, encouraging readers to develop a success-oriented mindset. A Year of Growing Rich serves as a practical and motivational tool for those seeking to build wealth and achieve personal growth throughout the year.

Bring About What You Think About by Eddie LeMoine

In Bring About What You Think About, published in 2013, Eddie LeMoine explores the power of thought in shaping one’s reality. The book delves into the idea that our thoughts and beliefs have a direct impact on the outcomes we experience in life, including financial success.

LeMoine provides practical strategies for changing negative thought patterns and focusing on positive, goal-oriented thinking. Bring About What You Think About is a motivational guide that encourages readers to harness the power of their minds to achieve their dreams and create the life they desire.

Each of these books offers unique insights into the world of personal finance, from building wealth and investing wisely to planning for retirement and achieving financial independence.

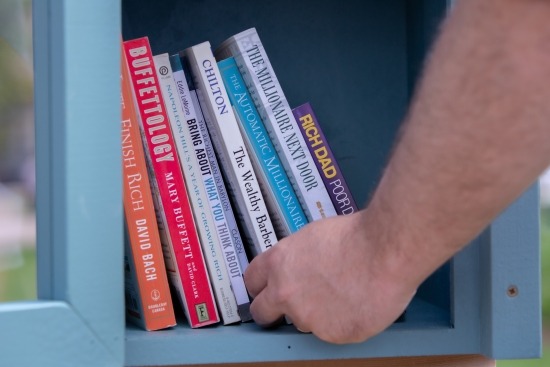

And all of these books are available at our “Little Financially Free Libraries” located at Halifax Commons, Hydrostone Park, and Peace & Friendship Park.

Our “Little Financially Free Libraries” are designed to make financial literacy accessible to everyone. By placing these libraries in parks and public spaces, we’re bringing valuable knowledge directly to the community. Financial freedom starts with education, and whether you’re looking for a step-by-step guide to becoming financially independent or seeking to understand the mindset behind wealth-building, these books are a great way to begin that journey.

Happy reading!

More Articles

Segregated funds: a great

estate planning option

Read More